How to Find Investors for Your Business Idea: Full Guide for Startups

How do you get funding for your software startup idea? Searching for investors is a very important step you’ll need to encounter when bringing your idea to life. Even the most prominently generated startup idea may face funding issues if not assessing all potential risks prior. However, don’t think that you’re alone in this struggle – only 20% of all startups survive to the implementation point, mainly because of financing challenges.

In this post, you’ll learn how to find reliable investors for your startup and avoid making mistakes during your first try.

What to Do to Get Investors for your startup?

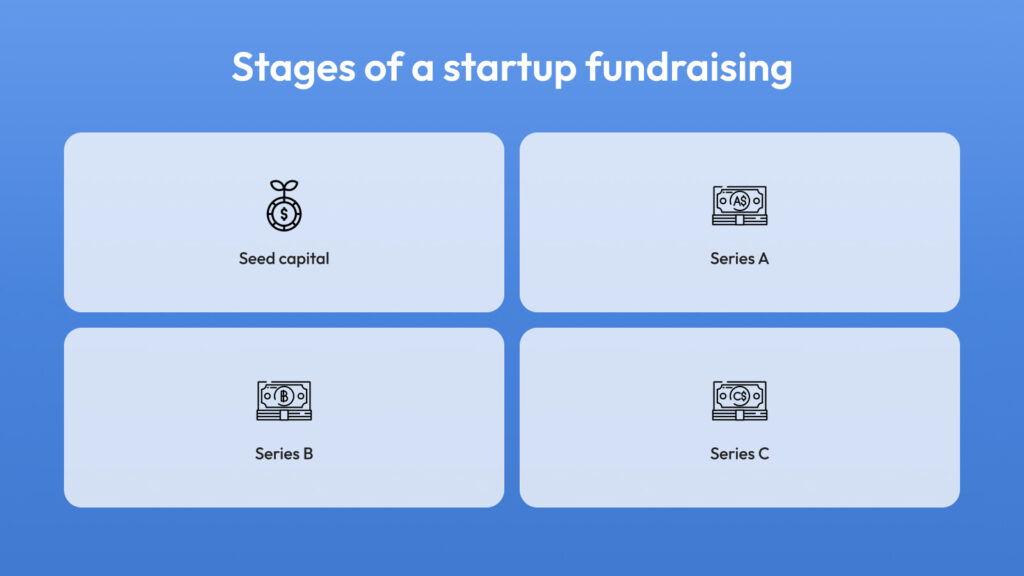

First and foremost, you’ll need to know what to start with. Usually, before getting down to business, you’ll need to establish a strong understanding of the startup money-raising scheme structure, which usually consists of co-called rounds, which we’ll now discuss below:

Everything starts from a seed round or seed capital. This term stands for the amount of financial resources you already have before reaching investors. Here is another thing: if you realize that you have enough capital without the additional aid of inner investors, you can start bootstrapping. Bootstrapping is the process that implies you, as a founder, rely exceptionally on your own money with no third-party investors’ involvement.

Then you’ll go to round ‘A’ of the startup money-raising checkpoint, engaging in meeting the investors and getting the first financial aid from them. Getting to the round ‘B’ implies that your startup business idea has already shown some particular success and has proved its own viability. At the same time, getting to the round ‘C’ means your startup has a real growth prospect and will attract more sustainable investors like private equity firms, venture capitalists, and even corporate investors. However, it requires more measurable and significant outcomes.

How to Choose a Proper Fundraising Strategy

You can consider several ways to get funding for your software startup, depending on what type of investors you’re seeking to find.

Here are the most commonly engaged types of investors:

- Angel investor

- Venture capital

- Business incubators

- Crowdfunding

- ICO (Initial Coin Offering)

Let’s overview each type in more detail below:

Angel investors

An angel investor is a single person who is ready to contribute financially to your startup with less profit guaranteed. Even though such individuals won’t give you much money, they’re more likely to make high-risk investments. These investors appear to be a great shot during the first stages of fundraising like a seed or ‘A’ round.

Venture capital

Venture capital engages more significant companies or large funds providing financial support to your startup. Investment funds are establishments that store the finances of individuals or companies that entrust them with their money and perform collective investments.

Usually venture capitalists are more attentive to their investments, mostly choosing small, reliable businesses or companies that have not much to lose, aiming to sell the company to the most beneficial bidder. Venture capitalists usually avoid investing into ‘raw’ and risky businesses.

Business incubators

Business incubators perform as a safe space for young startups to grow and strengthen, in other words to launch and get financial support. These companies provide you with seed capital, and provide you with essential industry knowledge by arranging various meetings and lectures with famous businessmen and other specialists who can share their experience and valuable insights.

Crowdfunding

Crowdfunding is an approach that allows you to raise money with the help of different platforms by collecting small contributions from a large amount of people. This is a great way to find needed investments to reach supporters of your startup ideas. By utilizing crowdfunding platforms, you’ll be capable of setting fundraising goals, presenting your project identity to engage with a broader audience, and even offering a certain reward in exchange for people’s contributions.

ICO (Initial Coin Offering)

This is a commonly used fundraising method in blockchain and cryptocurrency environments. It involves selling cryptocurrencies, tokens, or coins to investors in exchange for their contributions.

To use this approach, you need to:

- Create your own token

- Offer the token for sale to the public

- Make the token usable within your platform ecosystem

- Engage with trading in case of success of your project

Common Fundraising Mistakes

If you plan to create your own startup, keep in mind that there is always a chance that something may go wrong, even if it seems that you made everything the right way. It may depend on your startup business model, objective, and some other vital things we’ll now discuss below:

Unfamiliar niche

Expanding your project to a wider or even brand-new market can definitely be a hit, however, to achieve the desired success, you need to aim at the target very precisely. You’ll need to establish that it is more likely you already have quite a few competitors, but it doesn’t mean you should let them be ahead of you.

Idea theft

Unsurprisingly, the startup that appears to be only a copycat of an existing successful business won’t get considerable recognition or funding. You’ll need to focus on developing your own unique idea targeted to solve actual problems or pain points of your future users.

Poor tech assistance

Remember that even the brightest idea may be irrevocably ruined by poor implementation. So hiring tech professionals is not something you have to dismiss or cut investments on. However, it’s not a secret that higher costs don’t mean better development quality, so primarily focus on actual cases, tech stack, and the general experience of specialists in business domains similar to yours.

Single founder

Psychologically, it’s much easier for investors to trust their finances to the person who is more outgoing in terms of sharing their ideas and initiative with their fellow thinkers and family. It’s a common opinion that loners are more likely to be suspicious and incredulous to their partners and coworkers, and such disharmony within the team may lead to issues in future project development. Anyway, if you are the only founder of your startup and it is not like that, just note that you have way more chances to get robust funding by having co-founders as well.

With this note, we hope that you have enough insights to to find investors for your business idea. Do you have some great ideas to get investors for the business in an effecient way? Comment below or send an email to hellotechnovans@gmail.com.